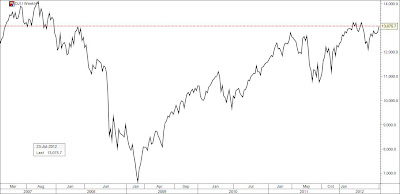

The last bar is the DOW's movement this week so far. Holding steady between the falling 21 week MA and the rising 8 MA. The fifth weekly sideways bar. To buy stocks the last five weeks has been meaningless for investment. The only reason to participate in the market is for so called day traders. Investors should keep staying away. This is why I do not report all small movements several times a day, because it is meaningless at present. It is summer and thin trade. Now and then rallies or drops occur when the big players intervene for a couple of hours. The trading pattern short term is close to impossible to predict. Nor are there any big news. Currently the quarterly company reports are flooding in but good results take out bad results. USA, Europe and Asia long trends look the same. They are flat. This can go on for a few more weeks until we come closer to a cross by the MA's.

Gold, Silver, Oil and Bonds are also sideways so my advice is still to stay in cash and wait. The EURO's trend is still down but the last two weeks it seems to get more and more difficult to push it lower because focus is turning slowly to the U.S. and the locked political situation that must be solved soon about the taxes.

Unless something important happens for the markets outlook there will be short daily comments from me as it has been for some time now.