Comparing the Japanese and Chinese big indexes with these of Europe and US you see that they look the same. One thing that has been on my mind for a long time is if it is possible that current big trends got a fourth instead of the fifth wave in. Technically both variants are possible. A fifth wave however will push the Asian stock indexes very much higher and do it now, the nearest few months before the big correction and Europe and US will do the same. The rise in all the indexes will then look like the end of of the 1927 highs and an enormous drop will follow in later part of 2014. Right now it seems to me that we are at the end of the fifth long term trend. Before I have seen this through it will occupy my mind. Hope to solve this before the end of 2013.

This blog is about how the world stock markets perform and which way they will take next.I have developed my own technical tools during 30 years to give the investor early warnings for coming big changes in the main trends and for the trader to take positions before the markets react. Click all charts.

30/11/2013

All things consdidered Nov 30, 2013

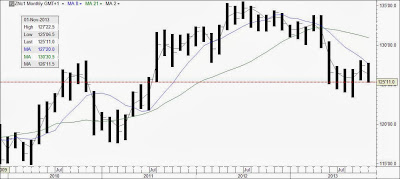

The two strongest indexes are the DAX and the DOW. They are now in the lead to the final top or maybe it has been seen last week.

Firstly DOW closed on its top line from the year 2.000. That is 13 years ago. The weekly chart hit its long term weekly top exact at its top line. Every time a trend has hit these lines the uptrend has been broken and next bar has turned on downside. I believe this will happen the first week in December. If the trend will hold just below for a couple of weeks for topping out and eventually intra day hit the rising line again I cannot tell. For my readers I recommend searching for short positions from now on.

Since all the big indexes in the world will go together I want NIK and HSI to technically continue to follow Europe and US. The FTSE daily trend is still down. This index and SWED have shown the way for bear markets for 30 years and I expect that to continue. Current situation does not show any signs of collapse technically or fundamentally but what I am talking about is the final top of the bull market since 2009. As soon as that top is clear the down trends will start. At that time you should have your plans ready for your short positions.

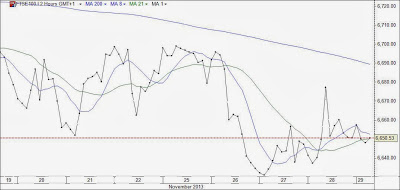

The 10 year yield on US notes closed at 2.75 percent Friday. The 2 and 8 months notes MA is now down. That means a break of 3.01 percent seems likely but I think the DOW and the 10 year Notes will follow each other exactly. I see no quick rally or drop in the bond market either. Maybe December will be calm with thin trading and then the 2 January will be the start of the powerful down trend I expect.

Firstly DOW closed on its top line from the year 2.000. That is 13 years ago. The weekly chart hit its long term weekly top exact at its top line. Every time a trend has hit these lines the uptrend has been broken and next bar has turned on downside. I believe this will happen the first week in December. If the trend will hold just below for a couple of weeks for topping out and eventually intra day hit the rising line again I cannot tell. For my readers I recommend searching for short positions from now on.

Since all the big indexes in the world will go together I want NIK and HSI to technically continue to follow Europe and US. The FTSE daily trend is still down. This index and SWED have shown the way for bear markets for 30 years and I expect that to continue. Current situation does not show any signs of collapse technically or fundamentally but what I am talking about is the final top of the bull market since 2009. As soon as that top is clear the down trends will start. At that time you should have your plans ready for your short positions.

The 10 year yield on US notes closed at 2.75 percent Friday. The 2 and 8 months notes MA is now down. That means a break of 3.01 percent seems likely but I think the DOW and the 10 year Notes will follow each other exactly. I see no quick rally or drop in the bond market either. Maybe December will be calm with thin trading and then the 2 January will be the start of the powerful down trend I expect.

29/11/2013

Subscribe to:

Posts (Atom)